Shares of the global financial sector fell due to the failure of US banks by about ten per cent, and about five per cent for the emerging markets, according to the “MSC” index from 9 to 16 March.

The aftershocks of the Silicon Valley Bank collapse, the first of the troubled US banks, led to continued losses in global bank stocks, as the assurances of US President Joe Biden and other policymakers did not succeed in calming the markets, as it prompted a rethink about the future of interest rates.

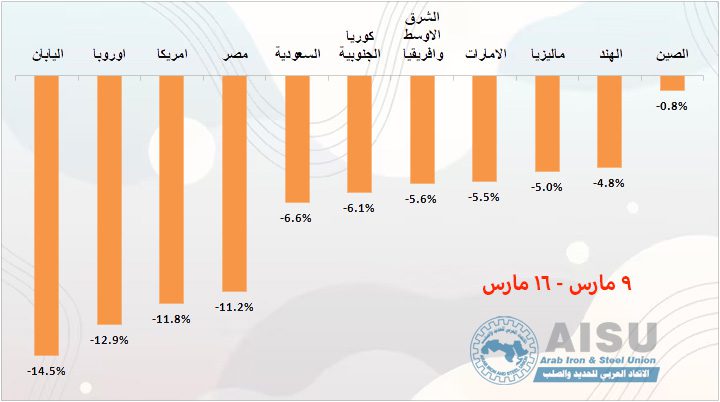

According to the monitoring unit reports in the “Al-Eqtisadiah” newspaper based on the financial statements of banks and companies, the banking and financial services sector performance varied globally, as the declines were significant in Japan, recording a drop of about 14.5 per cent in seven sessions. While bank stocks in Europe and America declined by 12.9 and 11.8 per cent.

Troubled US banks, Silicon Valley, Silvergate, and Signature, lost about $400 billion of their market value within a month, bringing their market value to less than $100 billion, compared to about $481 billion.

Market participants are still concerned about a new financial crisis reminiscent of the 2008 crisis that struck the world, but the picture is slightly different.

Over the past three years, banks have been accustomed to investing customer deposits in fixed-income securities when they could not lend for record profits.

But after interest rates jumped last year, the value of bonds purchased by banks fell, which left paper losses exceeding half a trillion dollars, forcing anxious bank customers to withdraw their deposits and liquidate their investment portfolios.

In the Arab world, the financial sector declined by about 11.2 per cent during the period in Egypt. However, it recorded less in Saudi Arabia and the UAE, at 6.6 and 5.5 per cent, respectively.

The governor of the Saudi Central Bank confirmed that there are no transactions for Saudi banks with troubled American banks. The Central Bank of Egypt also announced that banks do not have any deposits or financial transactions with Silicon Valley.

In the Middle East and Africa, the shares of banking and financial services declined by 5.6 per cent during the period, while in the Indian and Chinese markets were the least by 4.8 and 0.8 per cent.