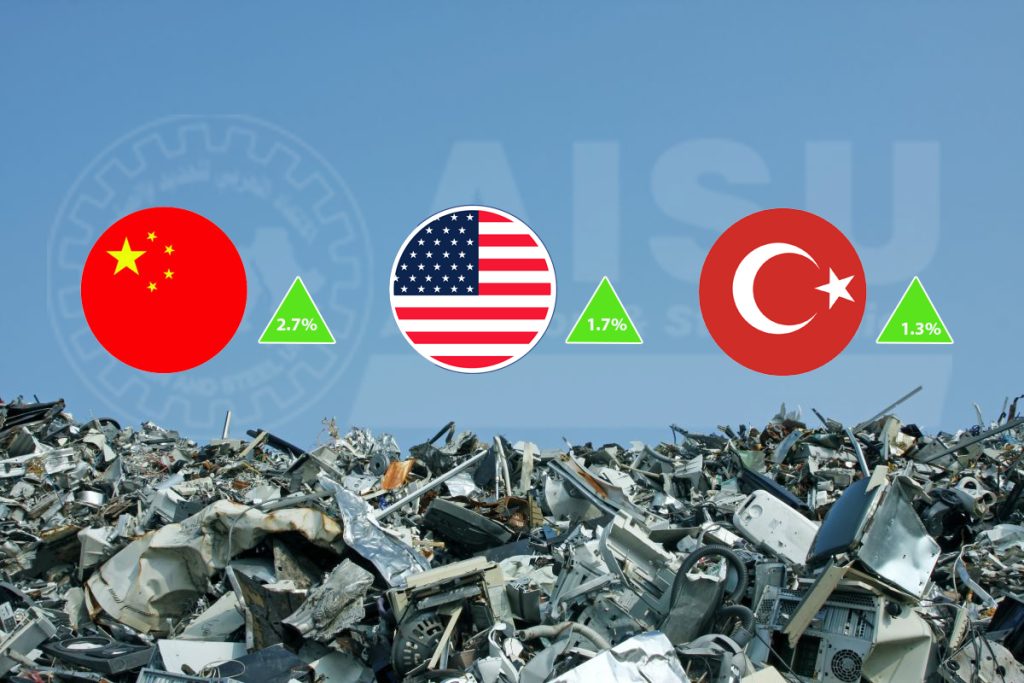

Scrap prices continued to recover in main markets last week as consumers showed buying interest after a long abstention period from new contracts. Activity in the Turkish market remains low, but it is sufficient for a slight price increase.

Ezz_Web_Banner_Side_280x200

qatar_steel2

SMS group

Steelco

Awards

SteelOrbis

steelradar

Arab Steel Summit

A report on global scrap price rise

- 7 June 2023

- 1:21 am

- Front news, Steel News, Steel Prices

Twitter

Facebook

Related News

Ezz-780-1

kuwit-steel3

mih-1

Latest News

Steel prices in the fourth week of April 2024

27 April، 2024

1:40 pm

Egypt: Iron and Steel for Mines and Quarries sells worth 34.24 million pounds in March

26 April، 2024

1:11 pm

Emirates Steel Arkan Recognized as “2024 Steel Sustainability Champion”

25 April، 2024

2:06 pm

Iron rises to the highest level in 7 weeks due to “Fortescue” and China

24 April، 2024

2:51 pm

China’s steel demand expected to be weak in traditionally stronger Q2

24 April، 2024

12:11 pm

Japan Launches Anti-Dumping Probe Into Chinese Graphite Electrodes for Steelmaking

23 April، 2024

11:01 am

The Chinese “Xin Feng” is establishing a factory for iron products in Egypt for $300 million

22 April، 2024

9:05 am

Steel prices in the third week of April 2024

20 April، 2024

4:49 pm

Biden pledges that America will retain ownership of US Steel

20 April، 2024

4:02 pm